Product

ION Analytics - Debtwire

Role

Design Lead

Responsibilities

Institutional Investors - Receive over 75% of their origination opportunities from Investment Banks. This is a very manual time consuming progress which is dominated by relationships with secondary players in the market. Having visibility on every investment opportunity is paramount.

Investment Banks - Wanted identify distressed issuers before the competition. Goldman Sachs keen to work in partnership with ION’s data science teams to create a predictive analytics score to automate tracking distressed issuers to give them the competitive edge over other investment banks.

Legal Advisors - Wanted to identify and originate profitable restructuring opportunities using an analytical and systematic approach, having clear visibility on what the investors and other legal advisors are doing in the market helps them stay informed and understand who to pitch to.

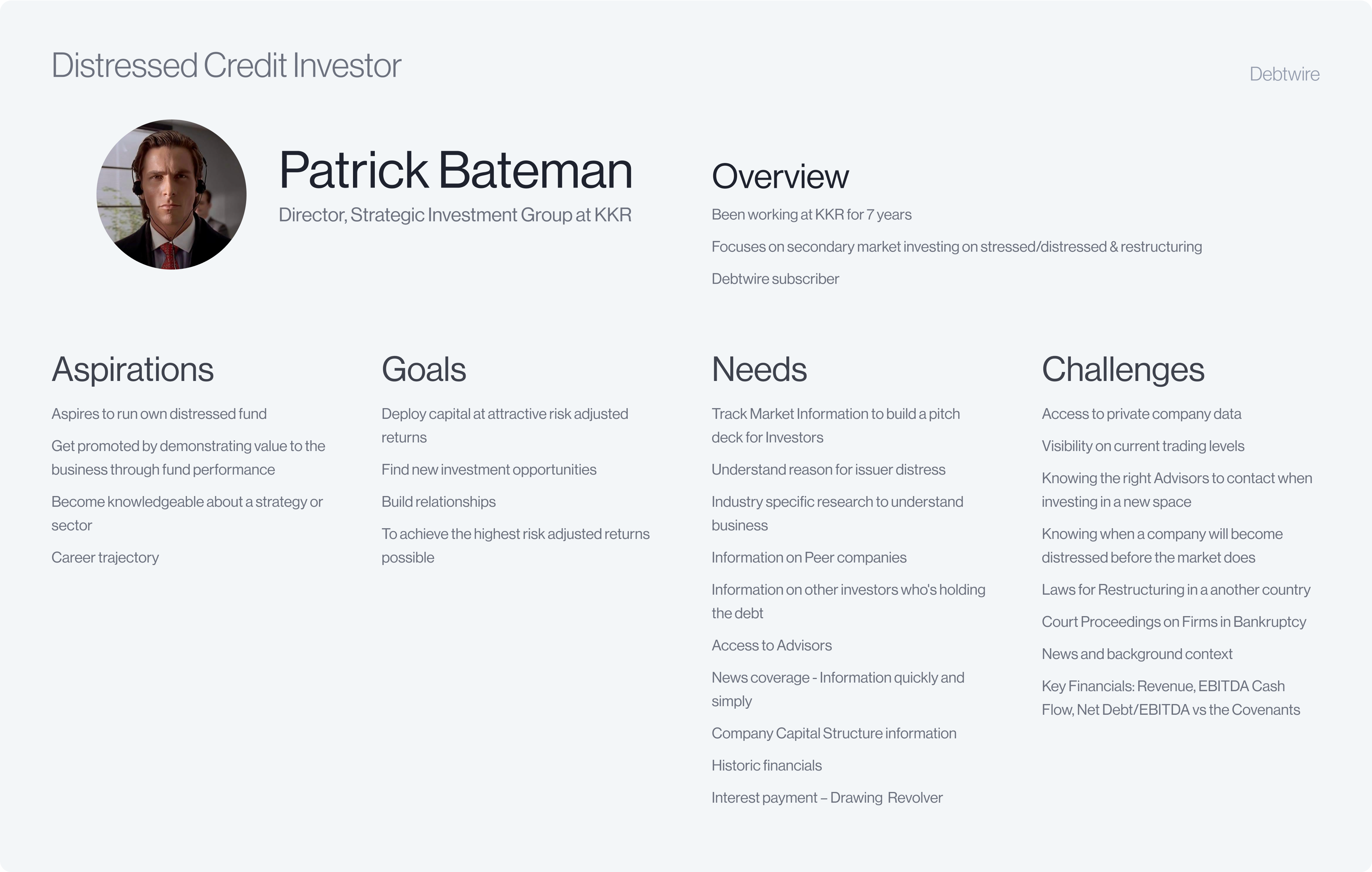

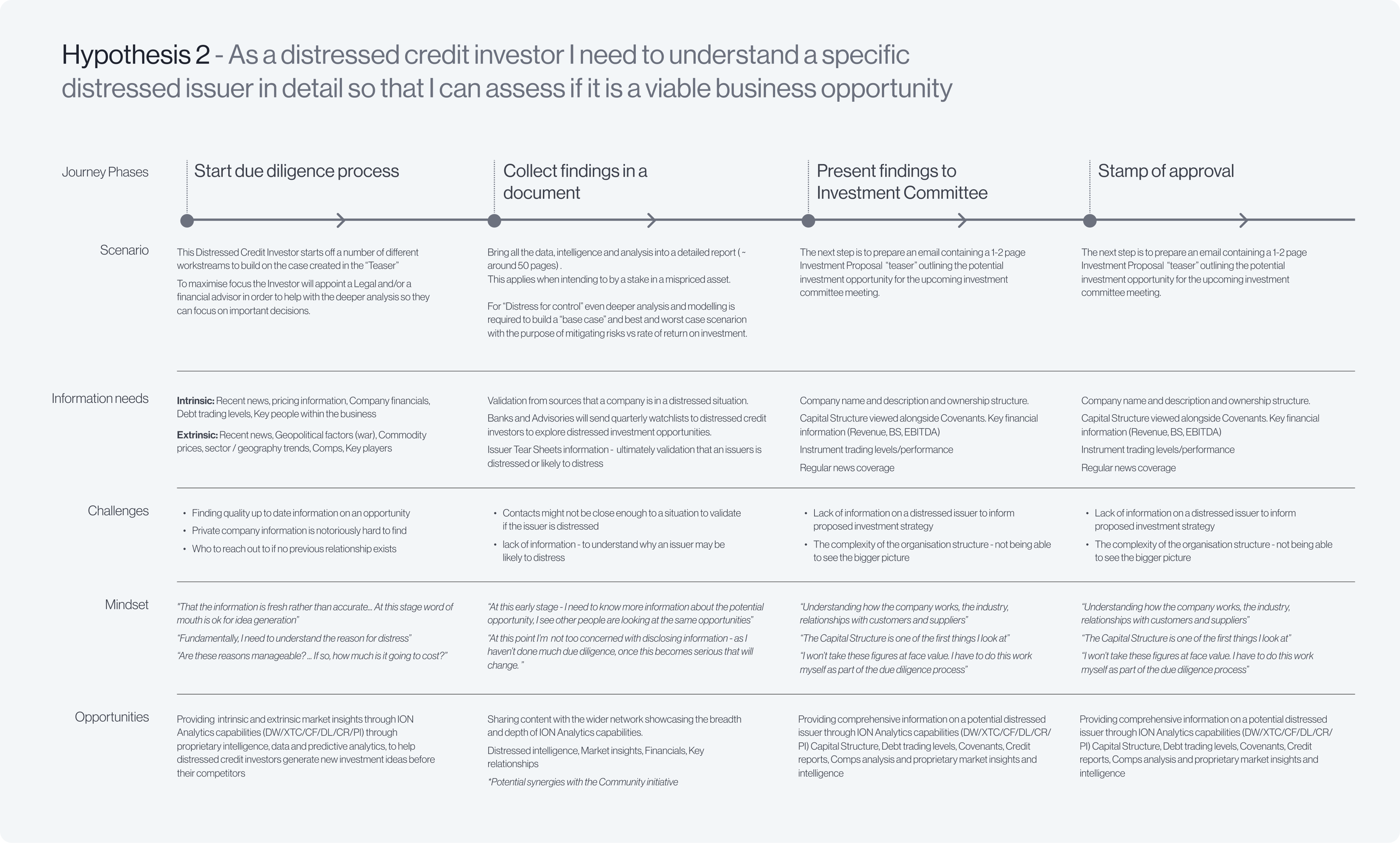

Accessing senior users like Distressed Credit Investors is challenging due to their high-level positions and limited availability. I facilitated a persona workshop with internal senior stakeholders in corporate development, who have closely collaborated with Distressed Credit Investors in the past. Creating a detailed persona encourages shared empathy for our core user and aligns stakeholders, ensuring everyone understands who we are building the product for and why.

One of the employees in the business used to work as a distressed credit investor in KKR's private credit team. I was able to schedule workshops with him and map out the origination process in detail covering the varios scenarios, information needs and challenges with a view to map the product capabilities within this process.

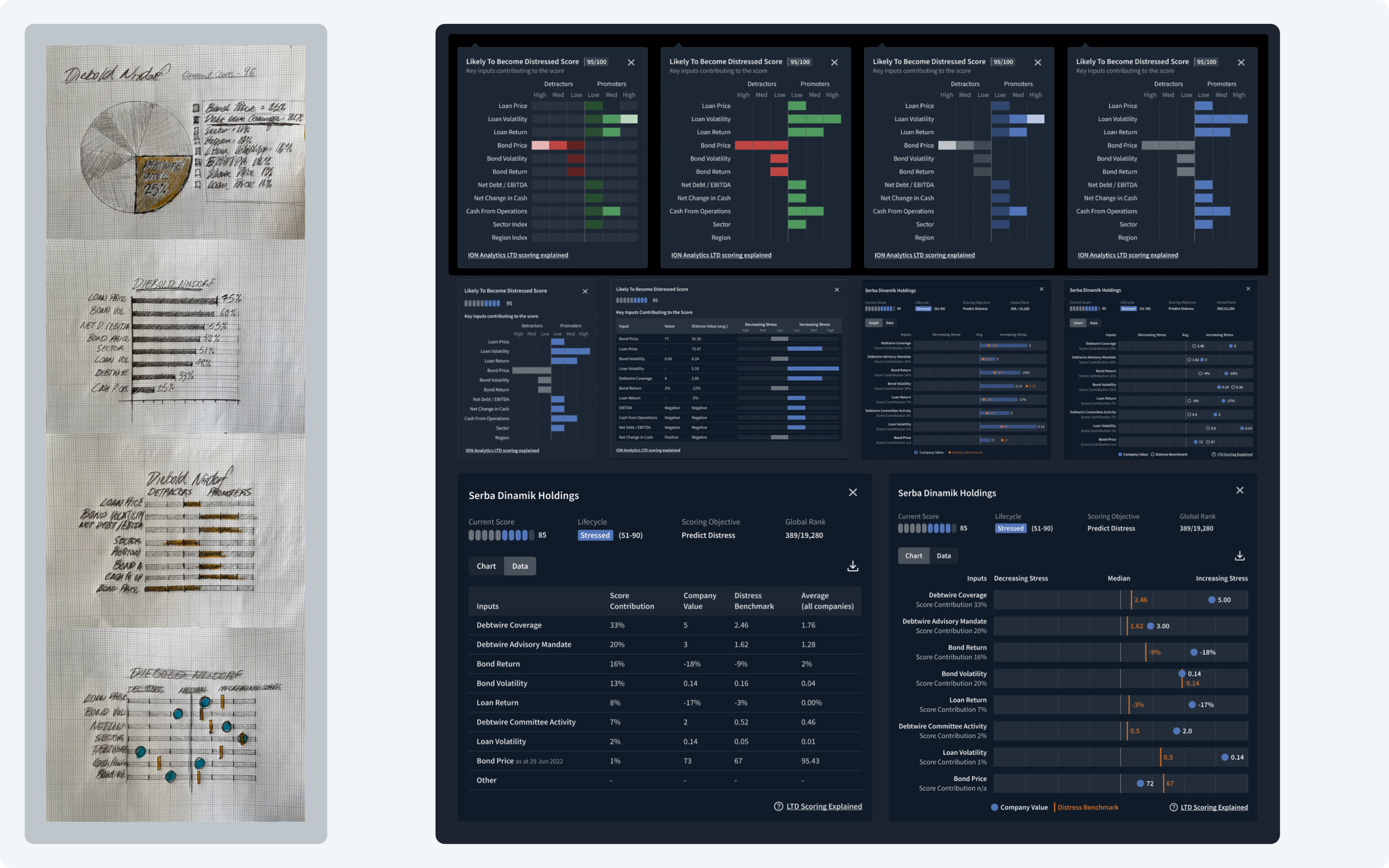

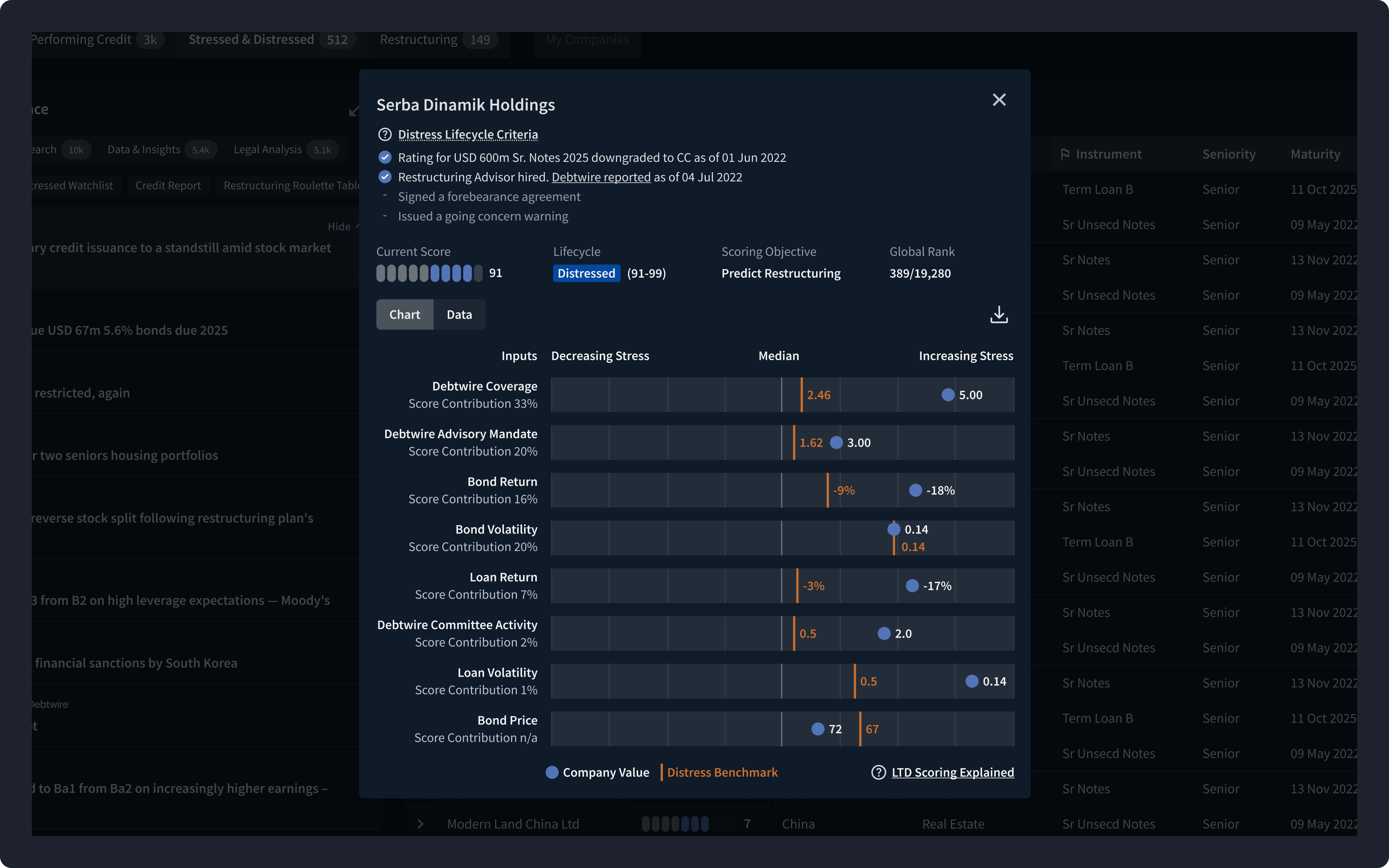

When we first introduced the score to users, their first response was, "How is this generated?" To address this, we collaborated Goldman Sachs who expressed interest in systemtic way of scoring issuers and our editorial, development and data science teams to refine the predictive scoring display based on user needs.

The score is calculated using a random forest algorithm that integrates hundreds of inputs. These include data points such as Net Debt/EBITDA, as well as unstructured data such as a "scoop" from a Debtwire journalist.

Through multiple internal iterations, we continuously tested and validated the scoring mechanism. Once the internal tests were deemed a success, we sought external user feedback to ensure the scoring was transparent and understandable

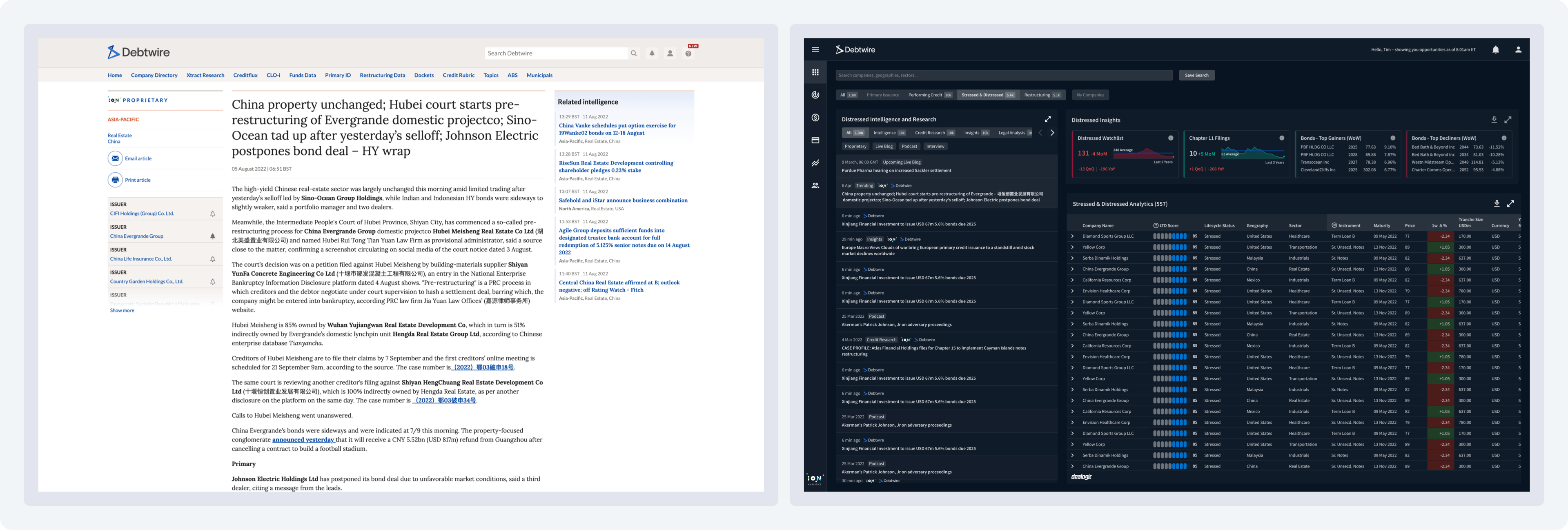

Distressed investors require advanced search and filtering capabilities to pinpoint issuers at risk of default or restructuring. These tools must allow for the exclusion of specific geographies and sectors, optimising team coverage. While the predictive score helps position an issuer within its lifecycle, the true value lies in precise data: capital structure, debt pricing, company financials, secondary metrics, and covenant reports. This accurate information is essential for thorough due diligence, ultimately determining the asset's investment potential.

Amid the growing trend of automating workflows for competitive advantage in the banking sector, ION partnered with Goldman Sachs to develop a groundbreaking tracking score for issuers throughout the LCM lifecycle. We designed advanced capabilities that provided users with scoring for over 100,000 issuers, offering transparency into the underlying inputs and tracking weekly score changes. Additionally, users could add issuers to a watchlist and receive instant alerts on significant changes, ensuring they stay ahead in the market.

Through our journey mapping workshops, we discovered that investors mandate restructuring lawyers to conduct in-depth analysis on distressed issuers, particularly in loan-to-own situations where they aim to acquire an equity stake. A secondary guiding principle was saving time by centralizing all necessary resources. We integrated the capabilities of a sister product, Xtract Research, by incorporating covenant reports and summaries into a comprehensive case profile. Additionally, we aggregated documents from federal court records and Debtwire reports. With powerful search capabilities across all databases, restructuring lawyers can swiftly find the precise content they need, saving them time and effort.

In recent years, private credit has emerged as a crucial source of funding for M&A growth and refinancing existing debt, offering an alternative to traditional bank financing and public debt markets. We worked closely with the executive team who gave us the mandate to create new capabilities which help direct lenders manage sponsor relationships, understand the market and identify investment opportunities in live auction processes and refinancing opportunities.

User Feedback - Initial positive feedback highlighting the perceived value and utility of the product and drive future product iterations.

Design System - Advanced NLP search, data visualisation, and AI predictive scoring algorithms extracted into the ION Analytics Design System.

Evolving Market Needs - Keeping up with the ever changing market needs to deliver new capabilities in the growing private credit market.

70%

A.I. Workflow Integration - of all users interacted with the predictive analytics score.

40%

User Engagement - increase in avg. session duration*.

*Compared to legacy platform

25%

Market Reach - increase in trial requests for Next-Generation Debtwire.