Product

ION Analytics - Dealogic exec.

Role

Design Lead

Responsibilities

Why Helping corporate executives with intelligence and data to independently assess capital and growth opportunities and take the right decisions in an ever-evolving environment.

Who Chief Financial Officers and senior executives; initial focus on Corporations with $40m to $160m EBITDA initially with a long-term goal to serve full strata of sizes.

What A fact-based and objective resource with data and unique insight on capital structure, funding options, growth analytics, advisor selection and support for M&A and maximise financial performance.

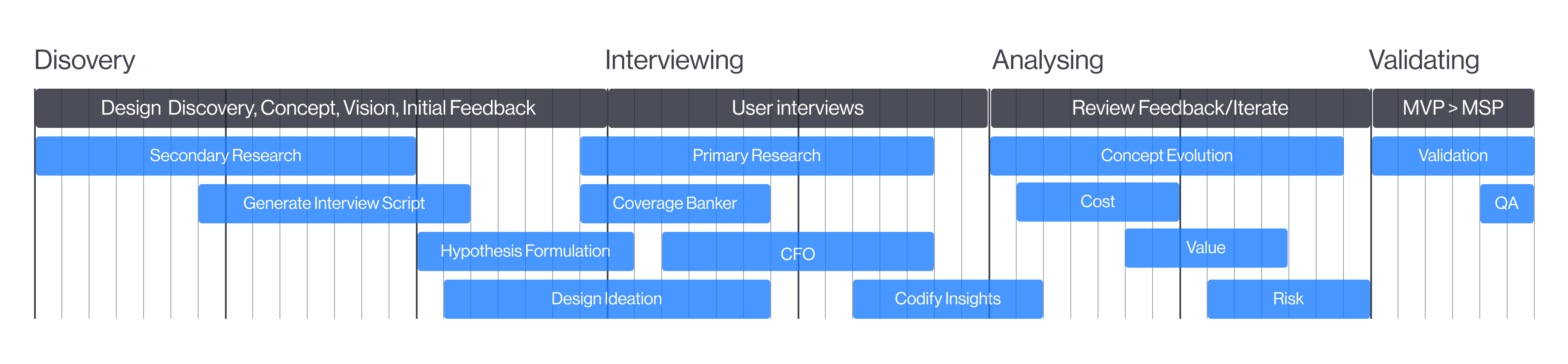

End State Vision What could the future look like? Is it transformational or valuable to our target persona? Quickly test concepts with real users.

Hypothesis Driven Form and test hypotheses for value with target persona, refining the concept as we learn.

Iterate Quickly With a narrow focus on a single persona, domain a core need focused on uncovering client value, polishing a bad concept wastes time and money.

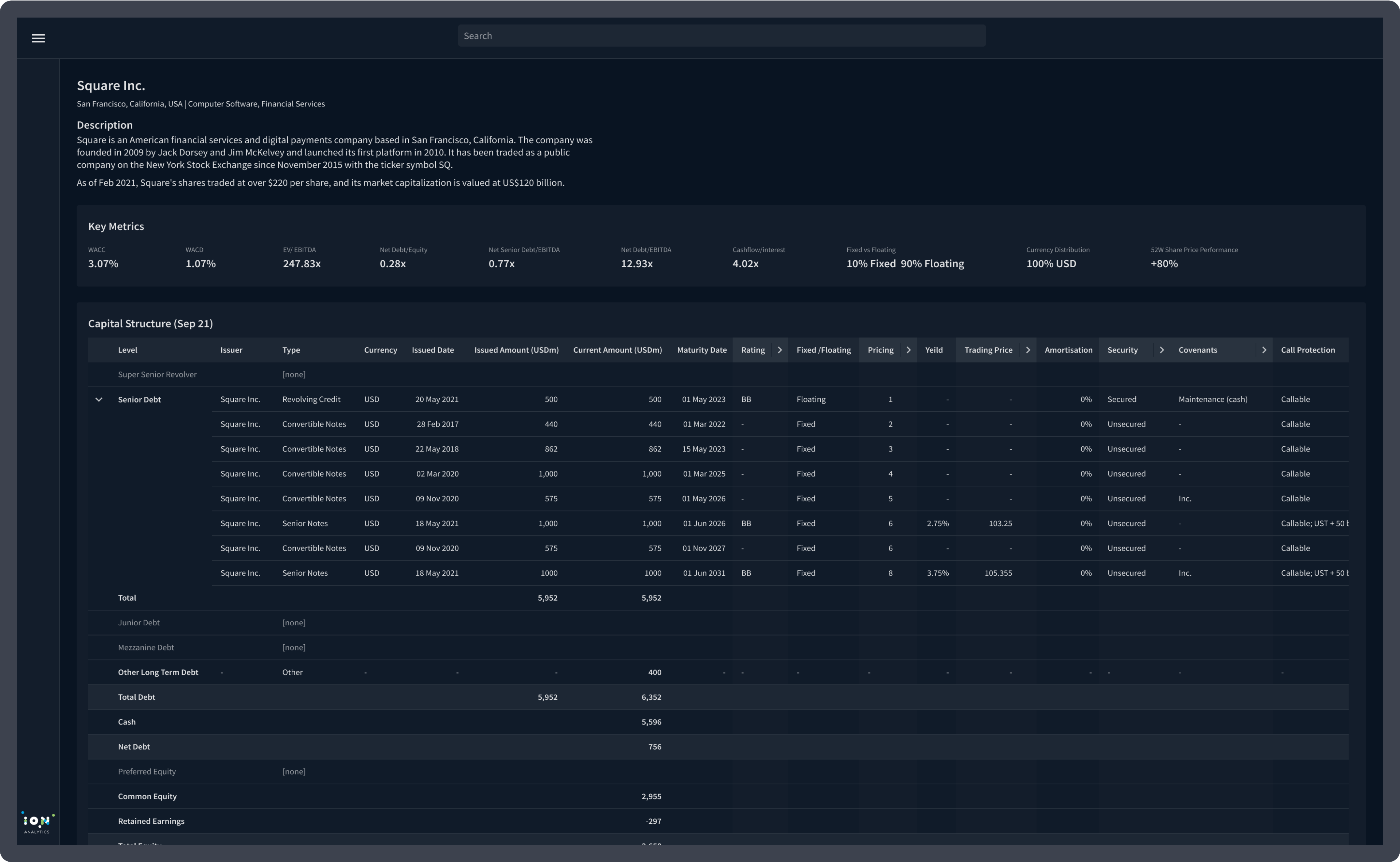

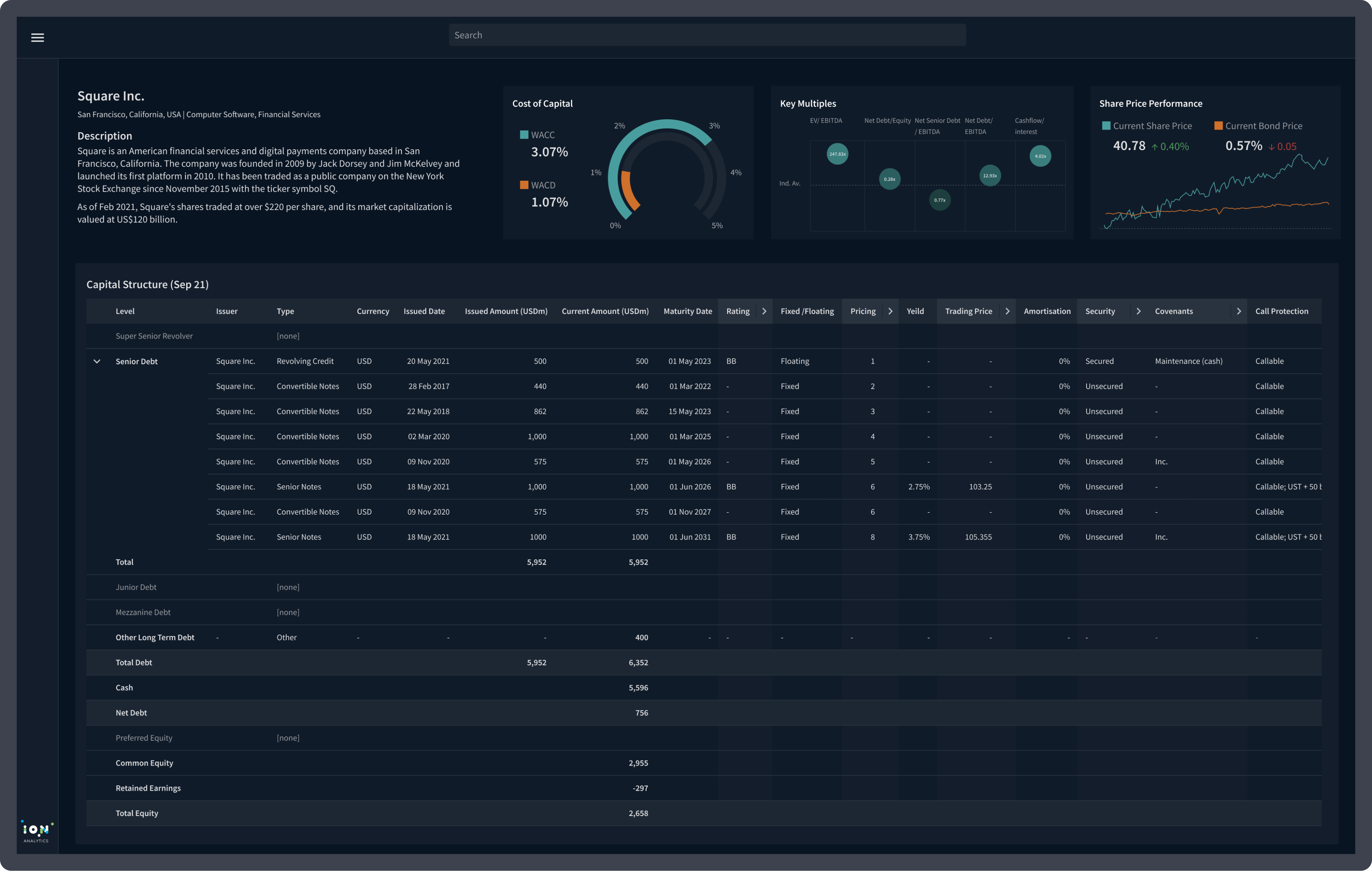

Iteration 1.0.0

Company name and description / Key metrics / Capital structure table

Iteration 1.0.1

Company name and description / Capital structure table / Cost of capital metric / Key multiples metric / Share price metric

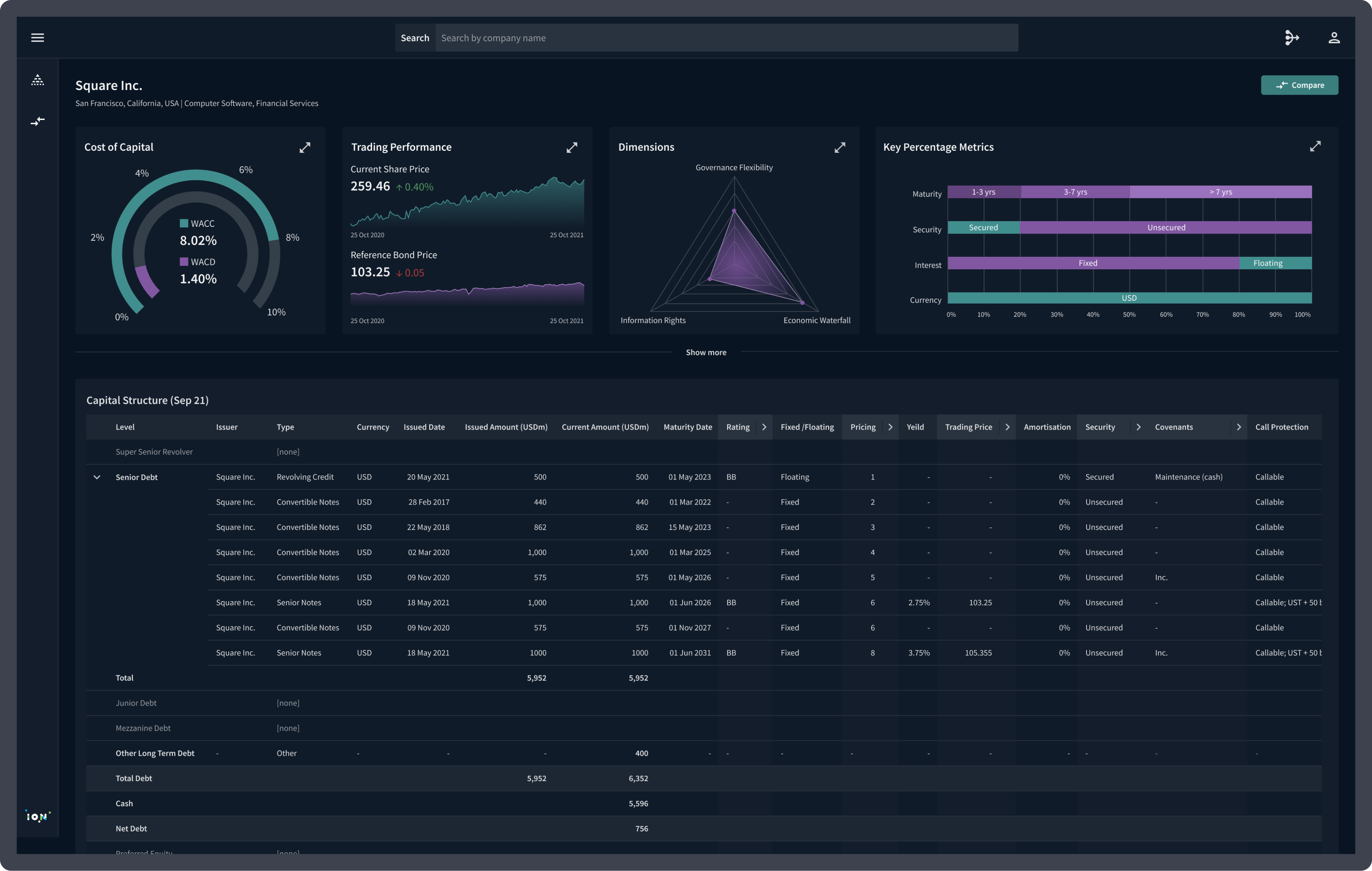

Iteration 1.0.2

Company name and description / Cost of capital metric / Trading performance metric / Dimensions metric / Key percentage metrics / Capital structure table

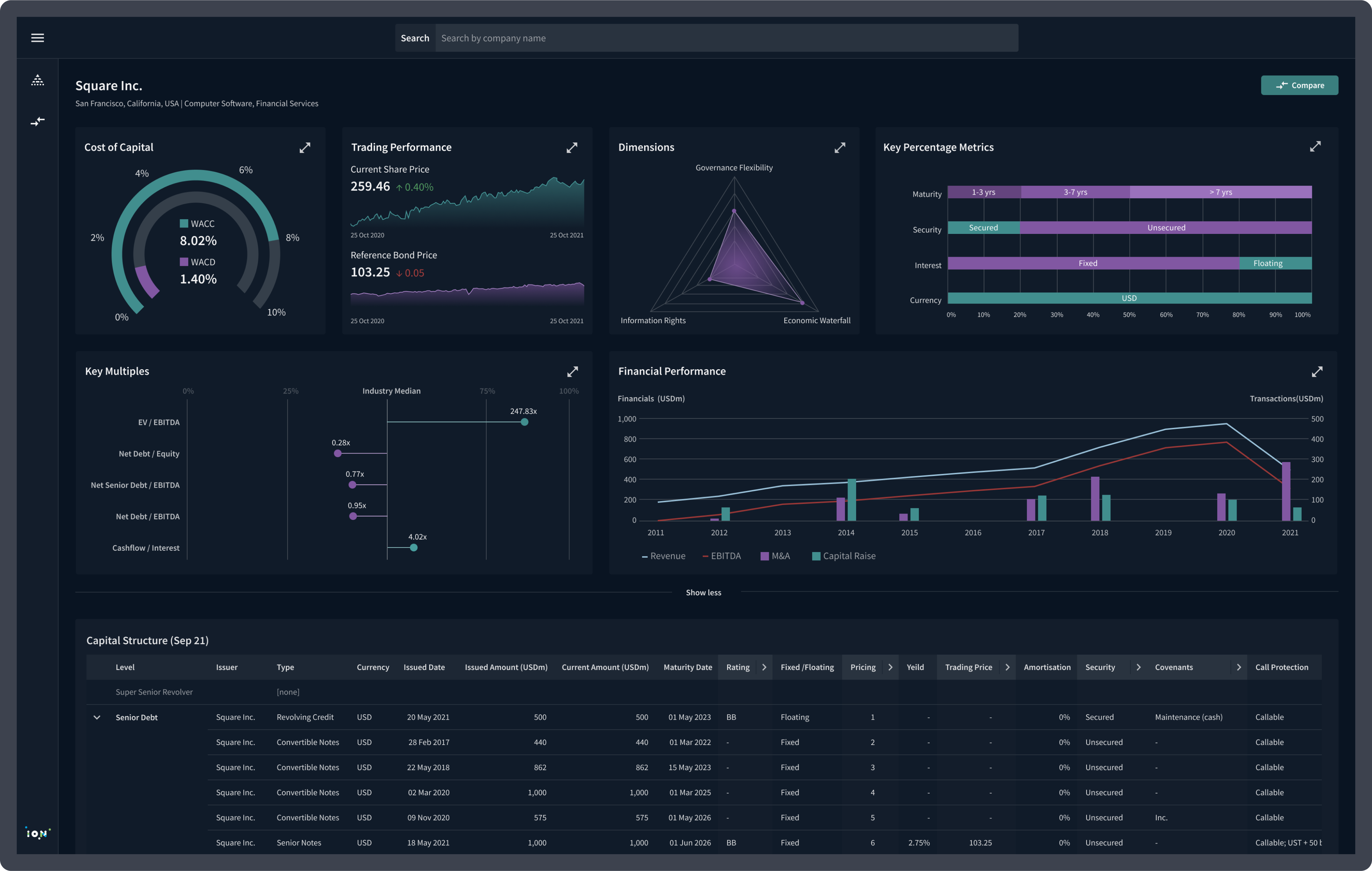

Iteration 1.0.3

Company name and description / Cost of capital metric / Trading performance metric /Dimensions metric / Key percentage metrics / Key multiples metric / Financial performance metric / Capital structure table

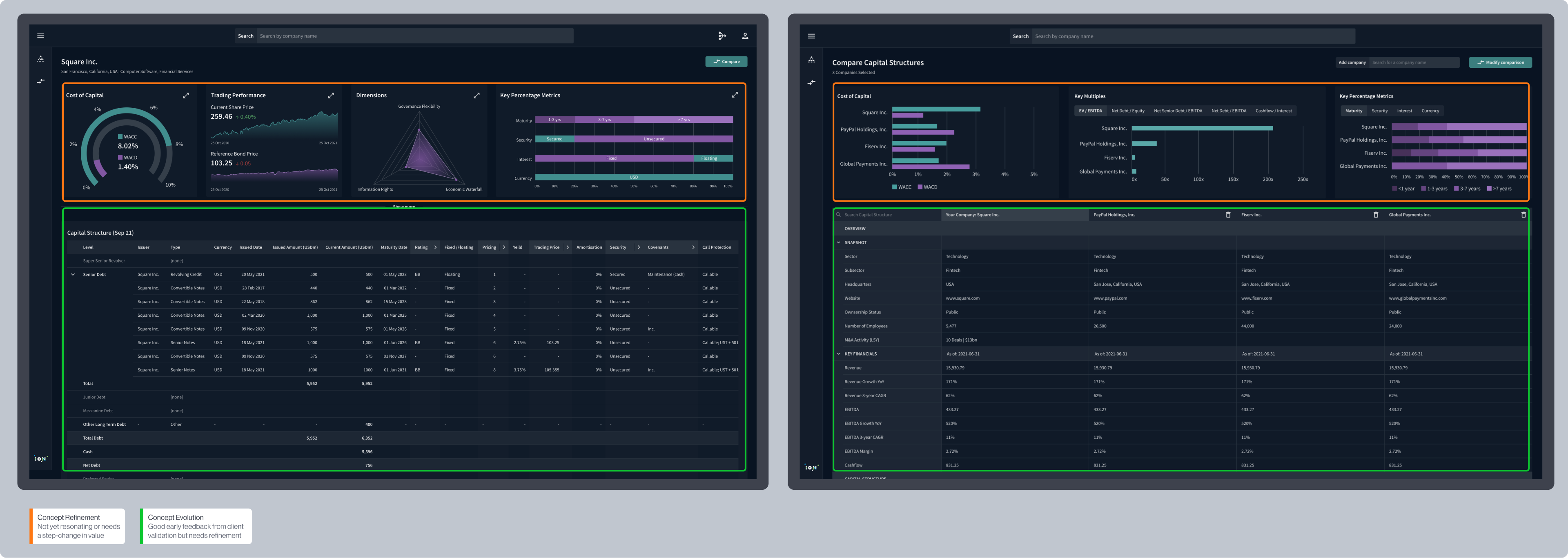

Initial feedback showed that 6 out of 7 CFOs already analyse their Capital Structure, and 5 out of 7 emphasised the strategic importance of comparing their structure with peers.

Capital Structure Insights While understanding capital structure is crucial, it lacked engagement as a standalone concept.

Data Visualisations Despite their visual appeal, data visualisations did not provide actionable insights, leading CFOs to question their practical value.

Workflow Optimisation CFOs expressed a clear preference for tools that help optimise their strategic responsibilities, highlighting the need for a workflow tool that delivers tangible, actionable outcomes.

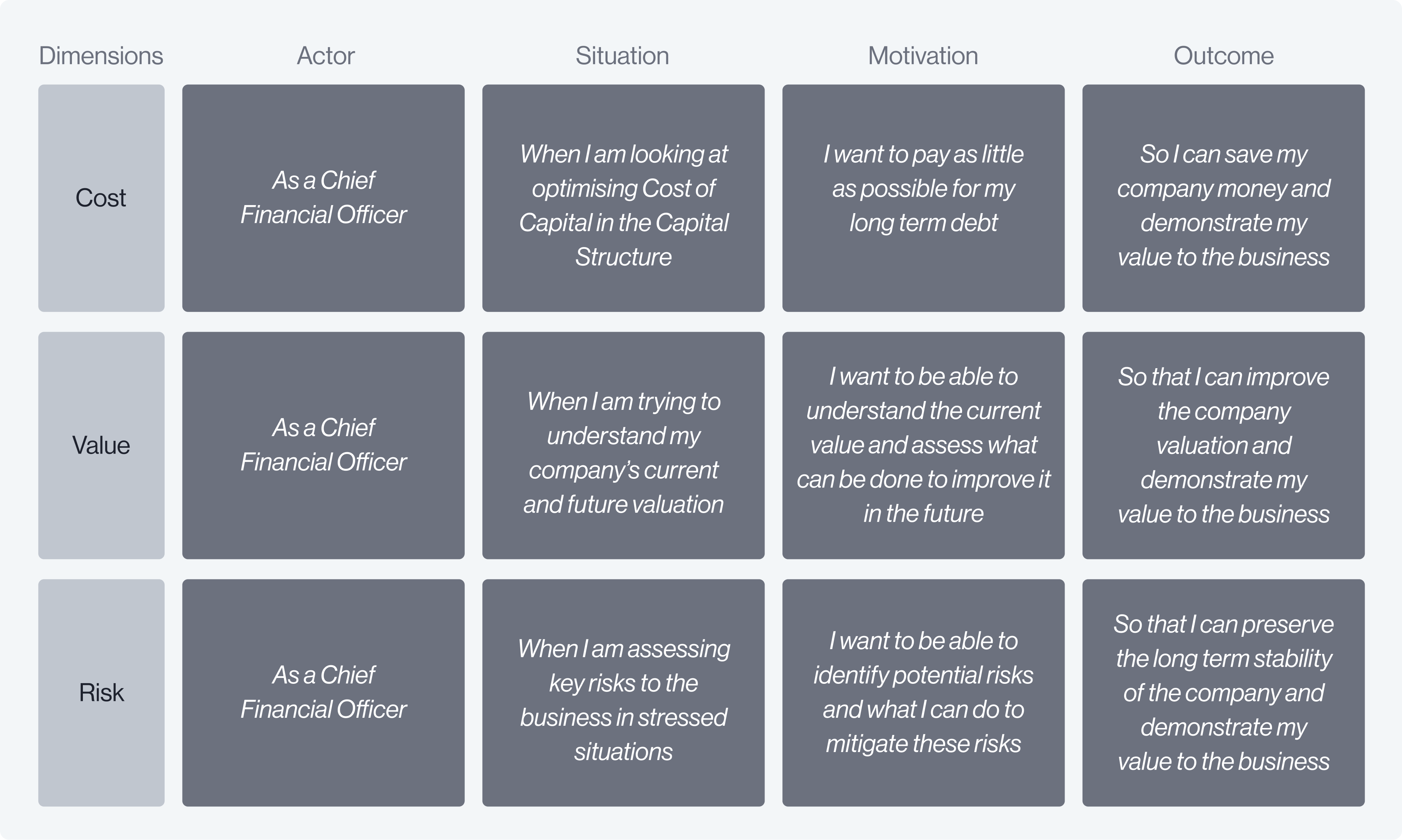

Our research on Capital Structure shifted from understanding its usage to identifying the CFOs' goals. By asking, "What are CFOs trying to achieve?" we focused on creating real value within their workflow. This approach revealed three key dimensions that resonate with CFOs: Cost, Value, and Risk.

Identifying Needs

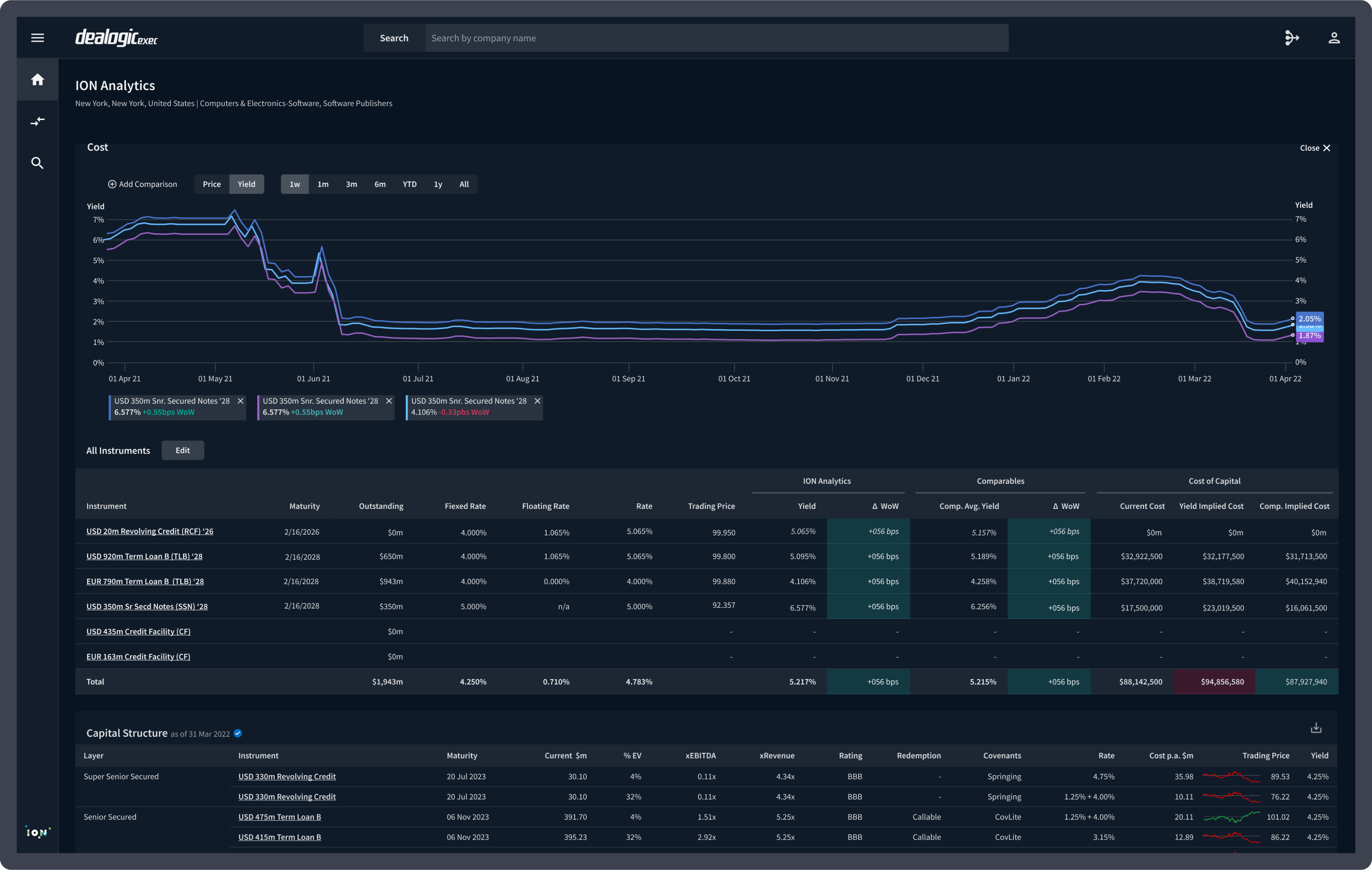

CFOs aspire to optimise long-term financing costs, questioning if they are overpaying and seeking actionable steps for improvement.

Current Challenges

Traditional reliance on Investment Banks for financing advice is seen as reactive and influenced by bankers' fees and bonuses, leaving CFOs feeling underserved.

Design Solution

I designed a platform that empowers CFOs to:

- Benchmark Debt Instruments Compare current and historical trading levels with industry peers.

- Receive Proactive Alerts Get notifications if they are overpaying or underpaying for their debt.

Outcome

This workflow provides CFOs with:

- Proactive Cost Monitoring Immediate access to cost data for independent analysis.

- Informed Discussions Data-backed insights for more effective conversations with Coverage Bankers.

Identifying Needs

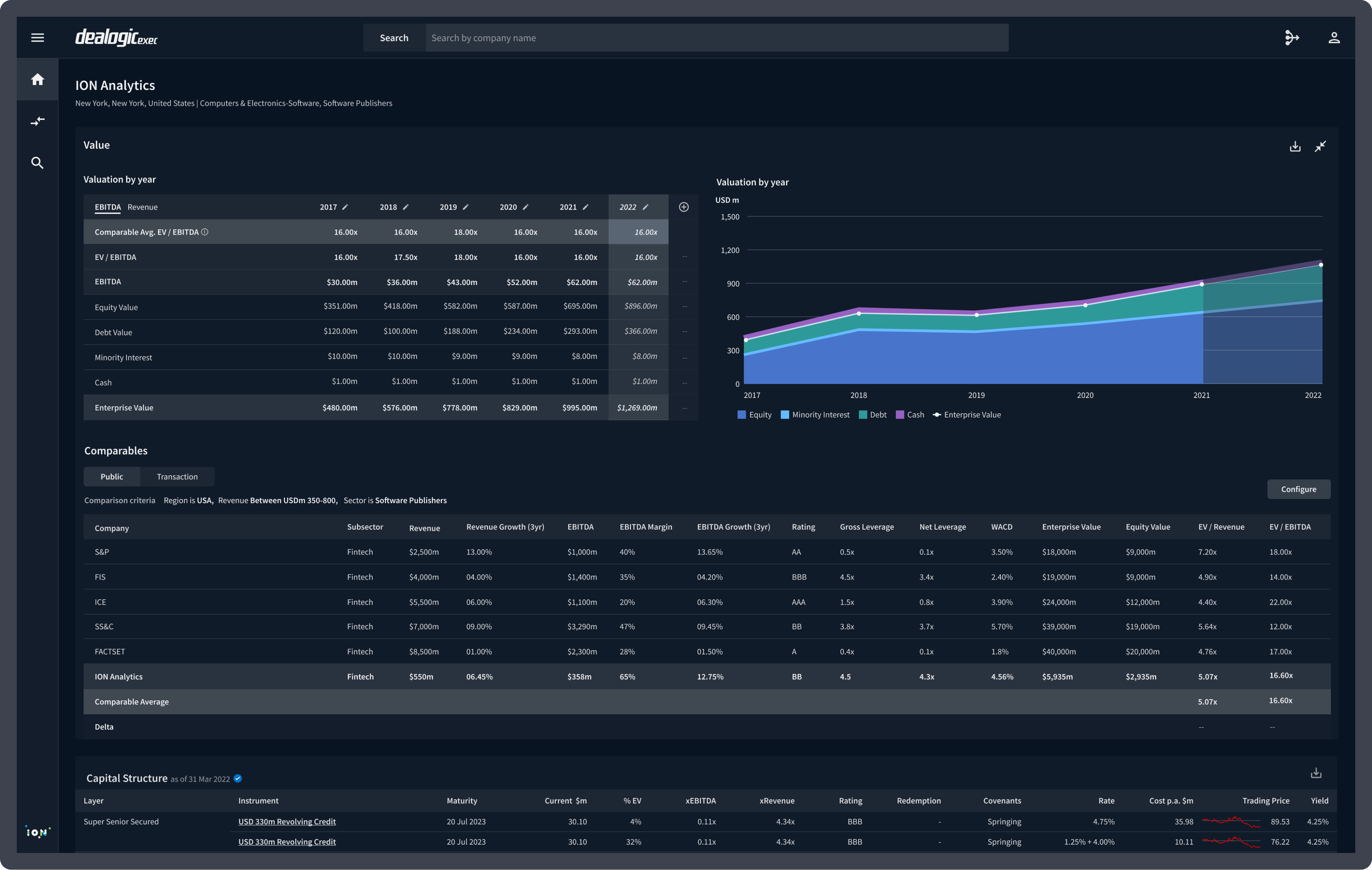

CFOs, along with other Corporate Executives, aim to improve company valuation.

Current Challenges

Currently, this process is ad-hoc, involving multiple spreadsheets and fragmented documentation.

Design Solution

I designed a platform that empowers CFOs to:

- Track Historic/Project Future Valuations Track historic and forecast future valuations based on business strategies.

- Benchmark Against Peers Compare company valuation against competitors, identified through a machine learning algorithm that adapts to CFO inputs.

Outcome

This workflow provides CFOs with:

- Streamlined Analysis A unified interface for efficient valuation tracking and projection.

- Data Driven Insights Enhanced benchmarking against competitors and “best in class” for refined strategic planning.

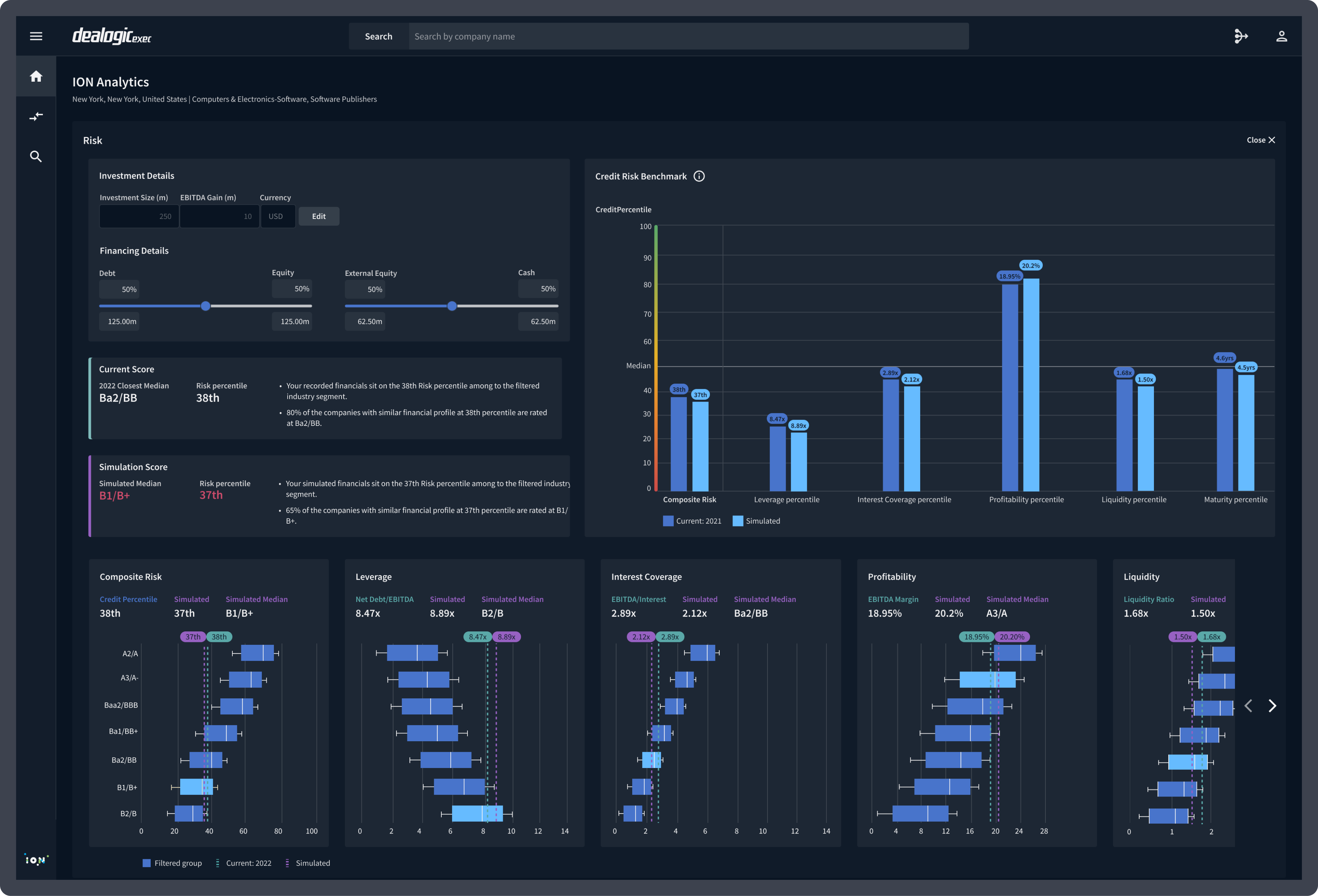

Identifying Needs

CFOs need insights into their credit risk scores assigned by rating agencies, which influence investment decisions.

Current Challenges

Currently, CFOs rely on costly consultations with rating agencies to understand the impact of financing options on their credit scores.

Design Solution

I designed a platform that empowers CFOs to:

- Simulate Financing Options Model various financing scenarios.

- Assess Impact on Ratings Understand how different strategies affect their credit scores.

Outcome

This workflow provides CFOs with:

- Risk Insight Immediate simulation of credit score impacts for proactive risk management.

- Strategic Planning Data-driven insights to make informed financing decisions.

75%

Active Users - completing core user journeys more than 3 times.

65%

Click-Through Rate - email alert engagement driving usage to platform.

14min

Session Duration - average length of time a CFOs spent on the platform.